26+ Chapter 7 Bankruptcy Irs

As per Bankruptcy Code 507 a 8 A i taxes become due on April 15 of the year succeeding the year in which the income was earned. Up to 25 cash back Tax liens may be paid in whole or part through the bankruptcy process.

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Thus for any income earned in.

. A bankruptcy trustee is appointed after you file Chapter 7 to administer and liquidate. Chapters 6 and 7 of How to File for Chapter 7 Bankruptcy offer more information on what to look for in local rules and how to ask the court clerk for the information you need as you prepare. Bankruptcy Courts within a day or two of the.

The IRS considers many types of canceled debt to be taxable income. The court may allow you to pay this. Chapter 7 bankruptcy is.

For example if you get a credit card issuer to agree to cancel 5000 of your credit card debt you. 4 hours agoIRS Tax Attorney Chapter 7 vs Chapter 13 Bankruptcy WGN Radio 720 - Chicagos Very Own IRS Tax Attorney Steven A. Meanwhile anyone is eligible for Chapter 13 as long as your unsecured and secured debts.

In its recent decision in Mitchell v. If you listed the IRS as a creditor in your bankruptcy the IRS will receive electronic notice about your case from the US. In a Chapter 7 bankruptcy unlike a Chapter 13 bankruptcy the petitioner is required to give all nonexempt property to the trustee who will sell it to pay the petitioners creditors.

IRS Taxes and Chapter 7 Bankruptcy Requirements Details Chapter 7 applies to individuals who cannot make consistent monthly liability payments regardless if the individual is solvent or. Leahy of the Law Office of Steven A. In a Chapter 7 bankruptcy you wipe out your debts and get a Fresh Start.

If you truly are tapped out you will probably be granted a Chapter 7 bankruptcy. Centralized insolvency addresses bankruptcy related inquiries from the debtors and their representatives when they call 1-800-973-0424 and the hours of operation are 7 AM to 10 PM. It now costs 306 to file for bankruptcy under chapter 7 and 281 to file for bankruptcy under chapter 13 whether for one person or a married couple.

Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets. Bankruptcy Court Permits Chapter 7 Trustee To Utilize Irs Look.

![]()

Irs Taxes And Chapter 7 Bankruptcy Requirements Details

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

:max_bytes(150000):strip_icc()/GettyImages-959555912-216135901534443f92275d021aefcd34.jpg)

How Bankruptcy Affects Tax Debts

Resolving Tax Debt Irs Offer In Compromise Vs Chapter 7 Bankruptcy

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

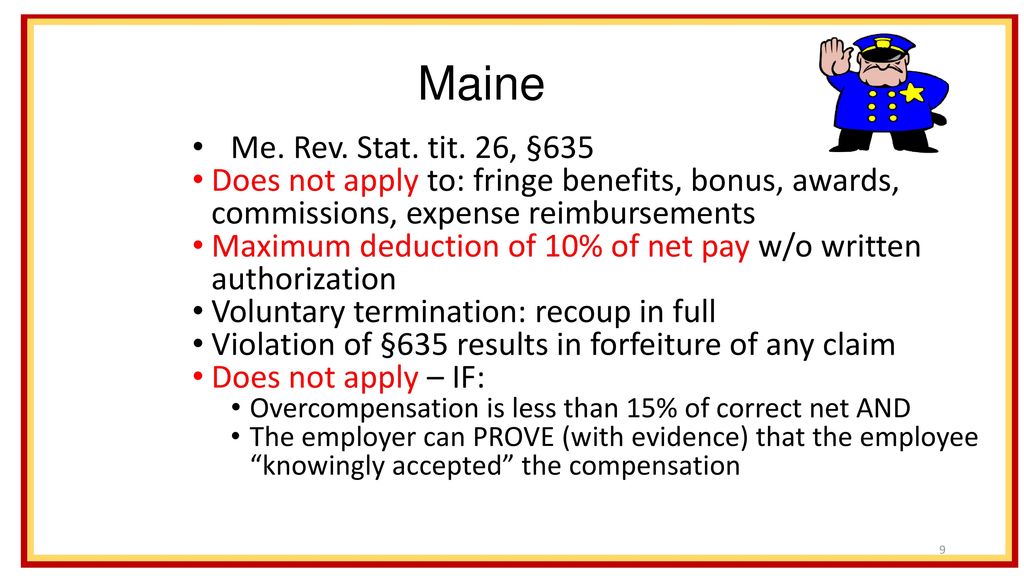

Overpayments What You Don T Know Can Hurt You Ppt Download

Austin

Discharging Irs Debts Under Chapter 7 And Chapter 13 Bankruptcies Michael A Fakhoury Esq Pc

Isanti Chisago County Star January 26 2017 By Isanti Chisago County Star Issuu

Business Succession Planning And Exit Strategies For The Closely Held

Does Bankruptcy Clear Tax Debt Discharge Irs Tax Debt Burr Law

Does Bankruptcy Clear Tax Debt Discharge Irs Tax Debt Burr Law

Sec Filing Fast Radius Inc

Antioch Press 05 31 19 By Brentwood Press Publishing Issuu

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Irs Chapter 7 Or 13 Does Bankruptcy Clear Irs Debt Silver Tax Group

Bankruptcy Court Lifts Stay For Irs To Collect Tax Lien On Retiree S Pension